ENGLISH

�ٴ�Ծ������ͽ����ƽ̨��¼��ڼ���MSCI ESG��������AA��

����ʱ��:

2022-07-28

����

������Ȩ��ָ����˾MSCI��Morgan Stanley Capital International

��Ħ��ʿ�����ʱ����ʹ�˾�������˱���˾�������ESG��Environmental

��Social and Governance

������������ἰ���Σ����������ƾ��2021�����ESG������������������

��2022��7��

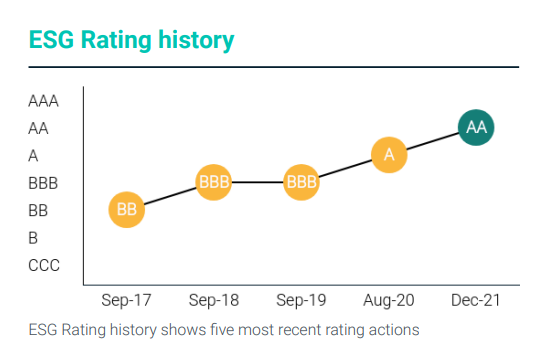

����ͽ����ƽ̨��¼��ڼ���MSCI ESG������BBB������������AA��������

��“��������������”�����“��Ⱦ�P�������ŷ�”�����ȫ��ͬ��ҵ����λ����

AA����ΪĿǰ����ҽҩ��ҵ���ˮƽ

������ȫ��ͬ��ҵ������ְλ���˴�����Ծ���Ƕ���ͽ����ƽ̨��¼��ڼ���ESG��������ĸ߶��Ͽ�

�������������ʱ��г�����ͽ����ƽ̨��¼��ڼ��ſ���������������Ч�ij�ʵ�϶���

��ͽ����ƽ̨��¼��ڼ��Ŷ��»�߶����Ӳ���������ESG���μܹ����������

������2020��6��30�ս������»�Ͻ��ESGίԱ��

���ɱ���˾���³�����ίԱ����ϯ

��������ESG����С����Ϊ��ִ�л�����ESGίԱ�������ƶ���˾ESGĿ�����ı

�����ESG�����ܹ�����Ӫ����

������ESG����ķ��պͻ���

����ͨ����ESGĿ��ļල������������ʵ�����ŵ�ESG������

2021��

����ͽ����ƽ̨��¼��ڼ��ſ�չ��ȫ���ŷ�Χ�ڵĶ�㼶�����ж�

�����ֻ���������������������������ҵ���¡��ٱ��˱�������Ӧ��������������������Ӧ����������Ӫ�����ջݽ�������ҵ��Ӫ�����ĸ�������

��ȫ���Ż��˼����������������Ӫ������

��ͽ����ƽ̨��¼��ڼ�����2021����������2021��-2025��̼����Ŀ�꼰2055��̼�к�Ŀ��

���ο�TCFD�����������仯���յĹ���

��ָ����ҵ��ϸ��������Ⱦ���ŷź���Դ����

���濢�����������ŷ���ͬ���½�6.7%�Ľ��������������������ҵ���ѻ��ISO 14001����������ϵ��֤��������Ҳ��ͬ������ESG��Ч�����������н��Ĺҹ��ƶ�

��ͨ����Ч�ļ�������ȷ����������Ŀ��ĸ濢

���ƽ���ɫ��̼��Ӫ��

ͬʱ

����ͽ����ƽ̨��¼��ڼ���Ŭ��Ӫ���Ԫ���������ԡ���ƫ�����Ѻ���������

����ѭ��������֯������Լ

���������Ͷ��ù�����Ϊ��������2021��

��������Ů��Ա��ռ��Լ48%

�����������Ϲ�����ԱŮ��ռ�ȴ�35%

��������δ��Ů��Ա������������40%�����»��Ա��������1��Ů�Գ�Ա��Ŀ����

����

����ͽ����ƽ̨��¼��ڼ��Ż����������

��2021�깫���Ծ���֧���������1,945��Ԫ

���ۼ�ǩ���������ι�����ĿЭ��16��

������ƶ����������Ա5,000����

����չ��ҵ���������������

��ͽ����ƽ̨��¼��ڼ���ʼ����“��������������һ”Ϊʹ��

����“��ҽҩ��ҵ������”ΪԸ��

����ı����������������ͬʱ

��һֱ����������������ҵ�������

���ر����

������������ˡ��ٽ���ϸ�����δ��

����ͽ����ƽ̨��¼��ڼ��Ž�����ʵʩESG����ս��

����̼��塢̼�к͡���������Ա�����������

�������ƶ����ŵĿ�����������

����MSCI ESG

MSCI��ȫ��Ӱ�������ʱ��г���������֮һ

�������������ȫ�����Ͷ���߽������IJο��߶�

����ESG��������ѳ�Ϊȫ�����Ͷ�ʻ������ߵ���Ҫ������MSCI��ESG�����������8,500�����й�˾

��ͨ��ץȡ35��ESGҪ������Ĺ�Ȼ��Ϣ��������

����������ѳ�Ϊȫ������ʲ����������ƶ�Ͷ�ʾ��ߵ���Ҫ�����Լ����ڼ�ܻ�����Ͷ���˹�ע�Ĺ�˾������Ҫ������

�����Ϣ